OCWEN LOAN SERVICING & SHORT SALE SHAKEDOWNS

By

Phillip C. Querin, QUERIN LAW, LLC

Website: www.q-law.com

Introduction. “Ocwen, Ocwen, Ocwen.” What a peculiar sounding name for a large company! Does it have some noble Greek meaning? Or perhaps a venerated Roman god high on the Pantheon of deities? Surely, a quick Google search will provide an etymology, and the mystery will be solved. Right? No, Nada, Nyet! There is nothing; just a name with no provenance. But wait! One genealogy site shows there to be a single birth record of someone with the name of “Ocwen.” However, that’s it. The trail abruptly ends. No other births, no family records, no divorces, no death notices. Just an odd name, a cipher, existing in a peculiar jumble of discordant letters. Hmmm. Sounds slightly demonic, like something from a Dracula script; the undead – existing to suck the life from its victims. Given the Ocwen we see today, perhaps that isn’t too far from the truth….

Well, no matter! That’s the namesake of a very large loan servicing company that has been getting the wrong kind of public attention these days. It recently agreed to pay the Consumer Finance Protection Bureau (“CFPB”) $2.2 billion, for all sorts of sordid and illegal loan practices over the years. I suspect their top execs are secretly ecstatic they got tagged so publicly by the CFPB, since it gave them instant membership in the Rogues Gallery of Miscreants, which includes the likes of Goldman Sachs, JPMorgan Chase, Bank of America, Wells Fargo, Citi, HSBC, Deutche Bank, and a host of other assorted scoundrels. To the Ocwen exec set, they likely believe it gives them “Wall Street Cred.”

Short Sale Shakedown. As most folks who are familiar with short sales know, typically, when a purchase offer comes in on a short sale, the seller’s broker notifies the appropriate lender or servicer, negotiates with the bank rep, and handles the process to closing. For these services, including procuring the buyer, a commission is paid by the lender and the funds are split according to the “offer of compensation” appearing on the local multiple listing service (“MLS”).

Over the past few years, Ocwen has become one of the third or fourth largest servicers in the country, purchasing servicing rights from the big banks.1 Many of these loans are non-performing, which has put them at the forefront of many short sales.

Recently it has come to my attention that Ocwen has apparently decided to actively insert itself into the short sale process itself. Here’s what appears to be happening:

- When a short sale seller lists their property and an offer is accepted by the seller, the listing broker notifies Ocwen in those instances when it is the servicer. Lately, Ocwen has refused to consent to the short sale (not because it is dissatisfied with the offering price), explaining that the seller did not complete all of Ocwen’s requirements. (See, Exhibit 1, attached) These new “requirements” mandate that the seller, through their broker, must first participate in Ocwen’s “Assisted Short Program.”

- Ocwen explains that this Program helps “Maximize (the seller’s) odds of approval and get full debt relief with Altisource’s assistance.”2 Altisource3 is a Luxemburg LLC, and it owns two subsidiaries, RealHome Services and Solutions (“RHSS”) 4 and Hubzu, an online website.

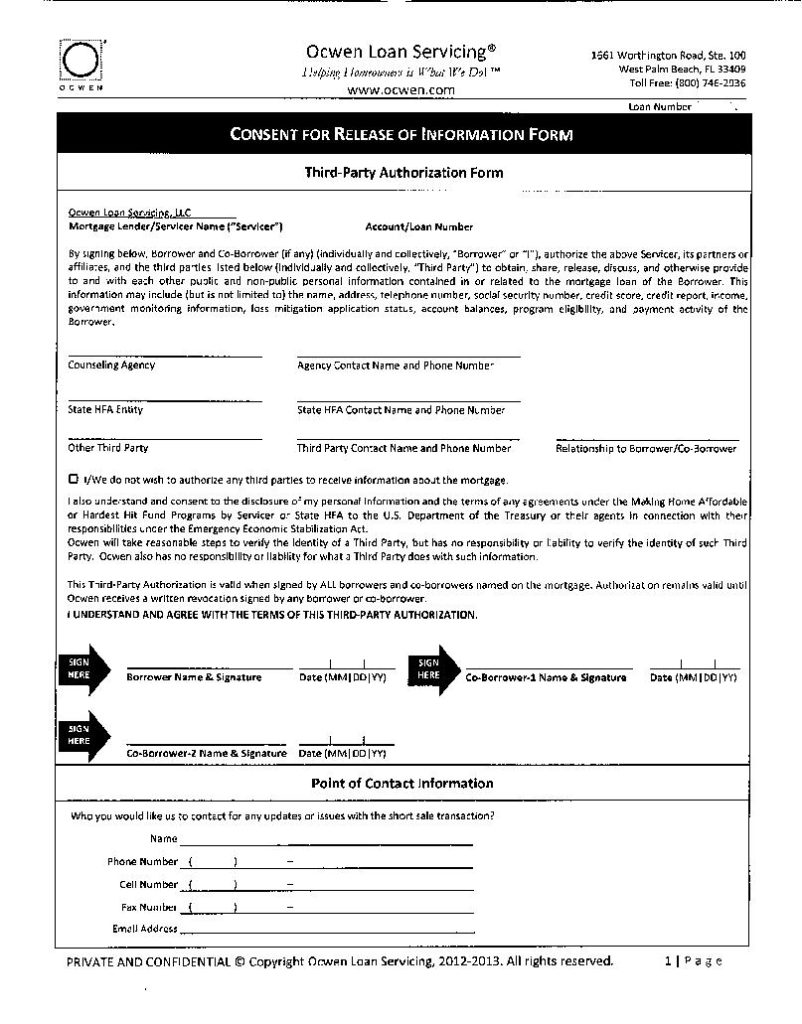

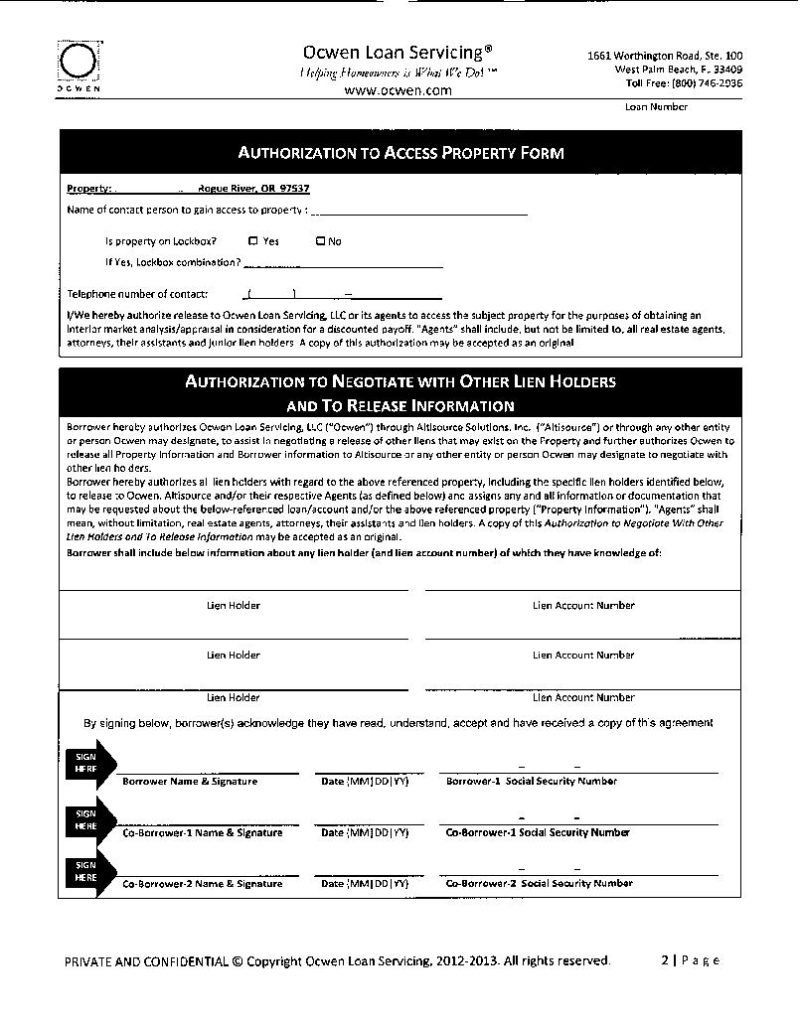

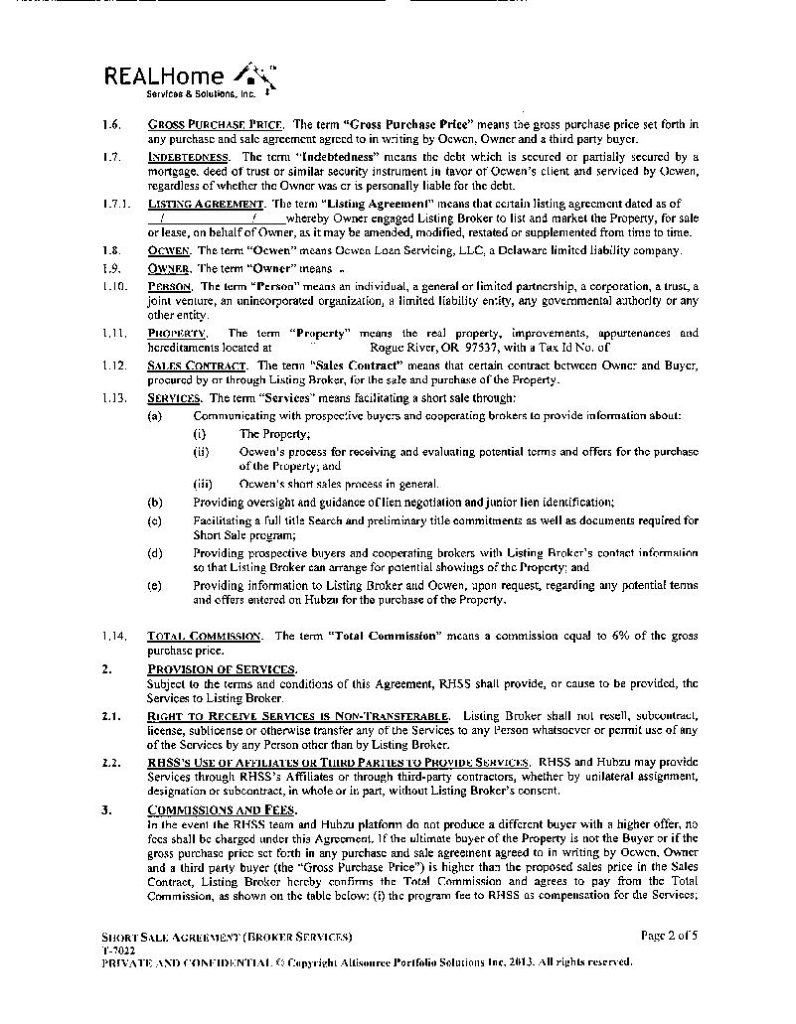

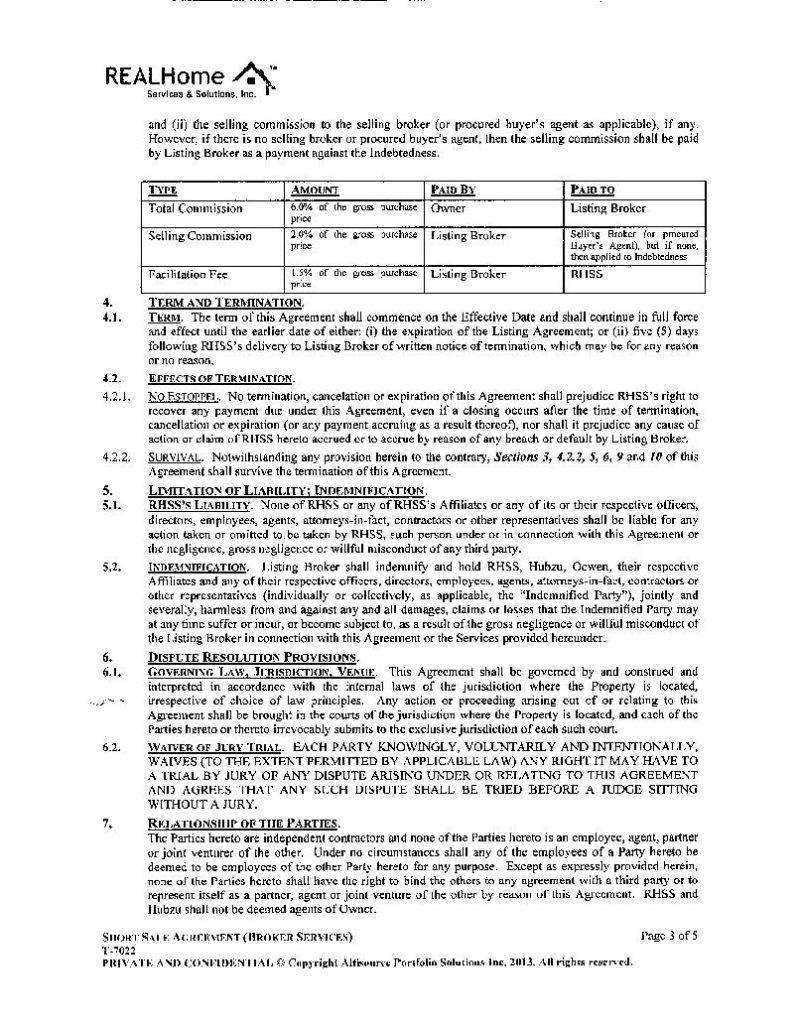

- Ocwen requires that the homeowner’s listing broker enter into a Short Sale Agreement for Broker Services with the Real Home Services and Solutions, Inc., (See Exhibit 2, attached) and Altisource will “…review all offers, including the previously submitted offer if it is resubmitted

***and will make a decision.” It also will provide a “full title search and preliminary title commitments….”

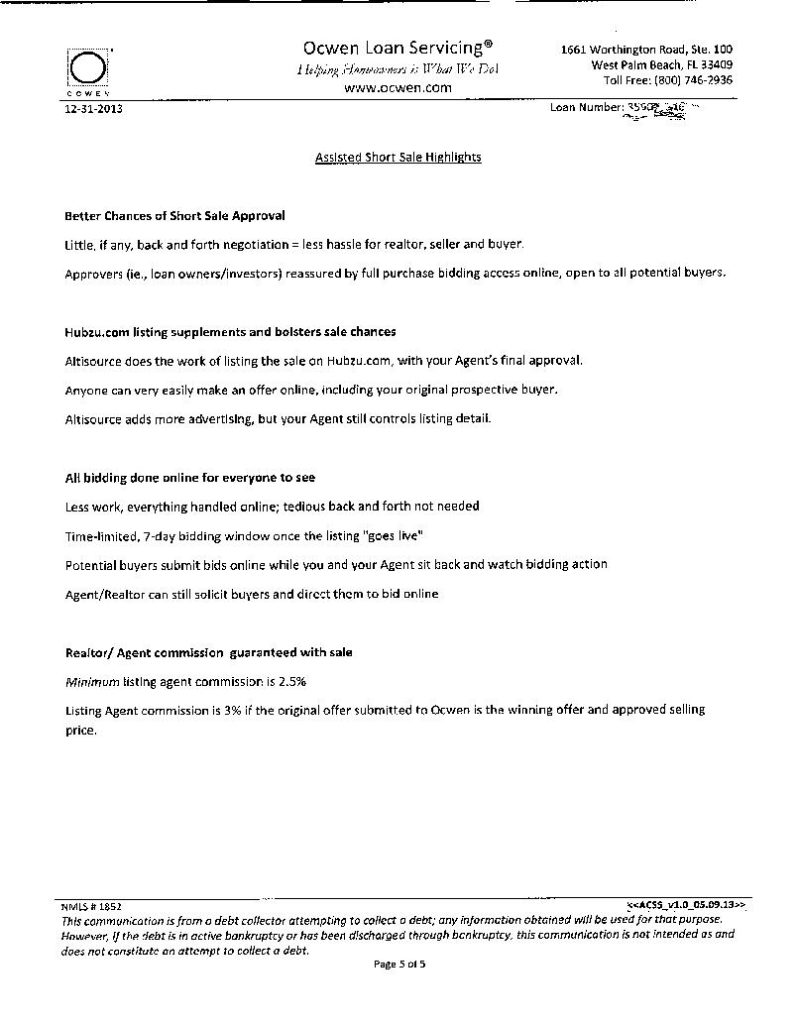

- Altisource lists the property for sale on Hubzu.com for a 7-day “online auction.” Hubzu is described in the Short Sale Agreement as “a national consumer portal which facilitates the sale of real estate by matching buyers and sellers via online marketing, auction and traditional sales techniques.”5 Ocwen states that through this process “approvers”[e.g. Ocwen] can be reassured that the winning sale price is the best offer available on the market.”

- If RHSS and Hubzu do not produce “a different buyer with a higher offer, no fees are charged under the Short Sale Agreement. If they do find a new buyer for a higher gross purchase price6 than that in the original Sale Agreement, the listing broker signing the Short Sale Agreement must agree to a commission sharing arrangement with RHSS and (presumably) Hubzu. The commission share, which is to be paid by the listing broker, includes a “selling commission” of 2.00% to the buyer’s broker and a “facilitation fee” of 1.5%. Significantly, if there is no buyer’s broker, that 2.00% commission is due to the bank for reduction of the borrower-seller’s loan. In other words, it appears that the listing broker’s commission is capped at 2.5%, even if, he/she is a disclosed dual agent [i.e. has entitlement to “both sides” of the entire commission], and instead a portion of full commission goes to the seller’s lender ostensibly for debt reduction.

- Remarkably, the Short Sale Agreement provides that “RHSS and Hubzu shall not be deemed agents of Owner.” However under standard agency law, they are at the very least, subagents of the homeowner.

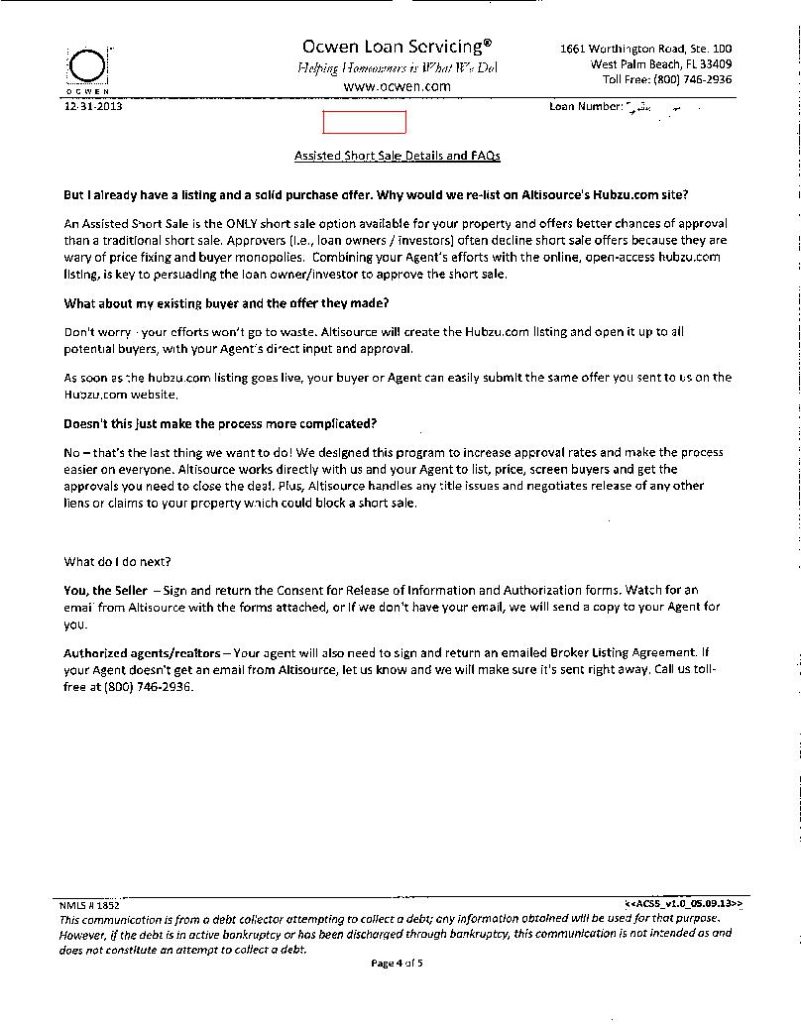

- In its “Assisted Short Sale Details and FAQs” (See, Exhibit 3 attached), Ocwen says that the Program “offers better chances of approval than a traditional short sale” because “…approvers (i.e. loan owners/investors) often decline short sale offers because they are wary of price fixing

This arrangement is patently illegal under both state and federal laws.

1.OREGON LAWS

a.ORS 696.290 prohibits the sharing of commissions with unlicensed persons. Hubzu, an unlicensed entity that is not even authorized to do business in Oregon, is apparently receiving compensation from a principal broker, e.g. the listing company.

b.ORS 696.301(6) makes it a violation for a licensee to intentionally interfere with the contractual relations of others concerning real estate or professional real estate activity. If RHRS is licensed in other states, I do not believe this would permit them to violate Oregon licensing law.

c.ORS 696.301 (7) makes it a violation for a licensee to: Intentionally interfere with the exclusive representation or exclusive brokerage relationship of another licensee. Same point as in b. above.

d.ORS 696.315 provides that a real estate licensee may not knowingly permit a nonlicensed individual to engage in professional real estate activity, with or on behalf of the licensee. Based upon the description of services and mandatory commission payment to Hubzu and Altisource, the Oregon listing licensee is being compelled to share his/her commission with an unlicensed person. ORS 696.290(1) does permit commission sharing with out-of-state licensees, but not if the out of state licensee is engaging in professional real estate activity inside Oregon. In this case, the described services clearly pertain to an Oregon transaction and are soliciting buyers, most of whom are presumably Oregon residents.

e.Oregon Administrative Rules 863.015-0200 and 0205 set forth the various types of agency relationships real estate licensees have with sellers and buyers. Essentially, you can represent one side, the other side, or both sides. In all instances, the licensee must give to their “principal” written agency disclosure. In this case, Hubzu and RHSS are saying they are not agents of anyone, even though they are clearly engaging in professional real estate activity under ORS 696.010(14). Oregon law does not contain a category of representation where there is no principal-agent relationship.

f.Of course all of the above violations assume one of these companies is licensed in the state of Oregon, although there is no evidence they are. If they are not so licensed, then they are engaging in professional real estate activity without a license, in violation of ORS 696.603(1). Accordingly, the Oregon Real Estate Commissioner is empowered to issue a cease and desist order under ORS 696.397.

g.By their activity in the sort sale process, Altisource, Hubzu, and RHSS are debt management service provider, and as such, must be registered with the DCBS. They are not. This violates ORS 697.662.

h.The description of services provided by Altisource in the Short Sale Agreement include title insurance for the transaction. ORS 731.354 requires that title insurers be registered through the Oregon Department of Business and Consumer Services. They are not.

2.FEDERAL LAWS

a.Section 8(a) of RESPA7 prohibits any person from giving or receiving a thing of value for the referral of settlement services in connection with federally related mortgage loans. While it is unclear how Ocwen benefits, i.e. financially or otherwise, it doubtless does receive some benefit from Altisource, RHSS, and/or Hubzu. Even if Ocwen does not receive a benefit, all three are “settlement service providers” under Section 8 and clearly are engaged in kickbacks and fee sharing between themselves.

b.Although the existence and disclosure of an affiliated business relationship acts to avoid the prohibitions on unlawful kickbacks under RESPA, the disclosures in the Short Sale Agreement fall far short of those required of under Appendix D to RESPA.

c.Section 8 of RESPA also prohibits the payment of unearned fees. Until Ocwen inserted itself in the conduct of short sales, the listing agent (or his or her designated negotiator) was solely responsible for negotiating the short sale with the lender or servicer. Ocwen, the lender’s representative, is now requiring that the borrower-seller and listing agent engage complete strangers to the transaction, to do what the real estate agents were already contractually obligated to do. In some instances, where they had already procured a buyer, Ocwen is requiring that the seller start all over again. The “first position” buyer is invited to re-submit their offer, should they choose. For this it appears these interlopers are to be paid a 1.5% “facilitation fee” which was otherwise a part of the real estate commission contractually promised to the brokers in the listing agreement and offer of compensation.

Conclusion. I suspect the above list of violations is only the tip of the iceberg. What is most disconcerting about Ocwen’s intrusion into the short sale process is that it slows down the short sale closing and reeks of conflicts of interest. While the borrower-seller is seeking consent from Ocwen for a foreclosure- avoidance solution, Ocwen is also requiring that even if there is a full-value offer on the table, the borrower-seller must nevertheless engage the servicer’s “affiliates” and start all over in the short sale process. This is a huge disservice to the brokers who worked to put the transaction together and to sellers and buyers who rightfully believed they would soon see it closed.

© 2014 QUERIN LAW, LLC

1For a 2012 Wall Street Journal summary of its business model, see article here.

2This implies that Altisource will negotiate with the holder of the second mortgage (if any) to secure a release of that lien, presumably with no continuing liability to the borrower. This may or may not include some contribution by Ocwen to the second lien holder, to incentivize it to consent to the short sale.

3Altisource is not registered with the Oregon Real Estate Agency. It is registered under several related names as Missouri and Georgia corporations, authorized to do business in Oregon.

4RealHome Services and Solutions is a Georgia corporation authorized to do business in Oregon. It is not registered with the Oregon Real Estate Agency.

5Hubzu does not appear to be licensed through the Oregon Real Estate Agency, and is not registered to do business in Oregon. For a sense of their reputation among brokers, sellers and buyers in the marketplace, go to link here.

6Note, nothing is said about a higher net sale price. It is entirely possible that the title services provided by Altisource could actually result in a lower net sale price. and buyer monopolies.” In my experience, this is simply incorrect – today, the vast majority of short sales are routinely approved by lenders and servicers, once they have vetted the purchase price, fair market value, and pre-approved the seller’s settlement statement, i.e. the HUD-1.

7The National Association of REALTORS® explains RESPA §8(a) thusly: “RESPA is also an anti-kickback act. The idea here is to prevent the payment of kickbacks and other fees, which drive up the costs of the product to consumers. Section 8(a) of RESPA prohibits any person from giving or receiving a thing of value for the referral of settlement services in connection with federally related mortgage loans. Thus, lenders may not pay, and real estate agents may not receive, fees for the referral of settlement service business.”

Exhibit 1

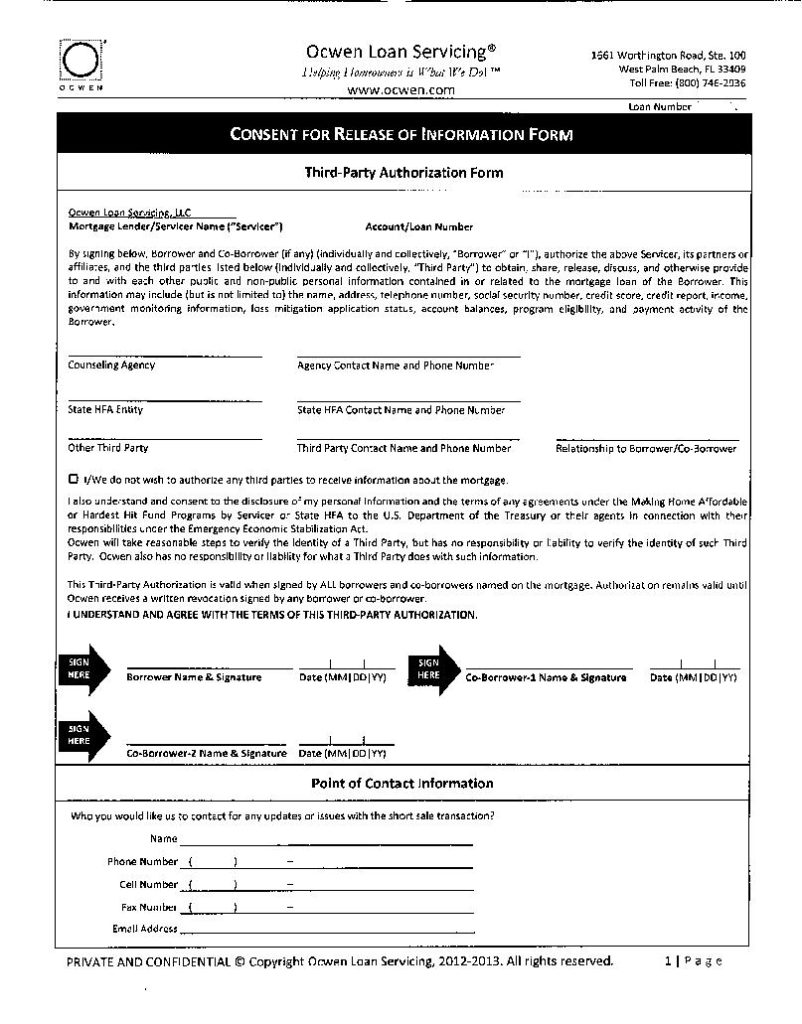

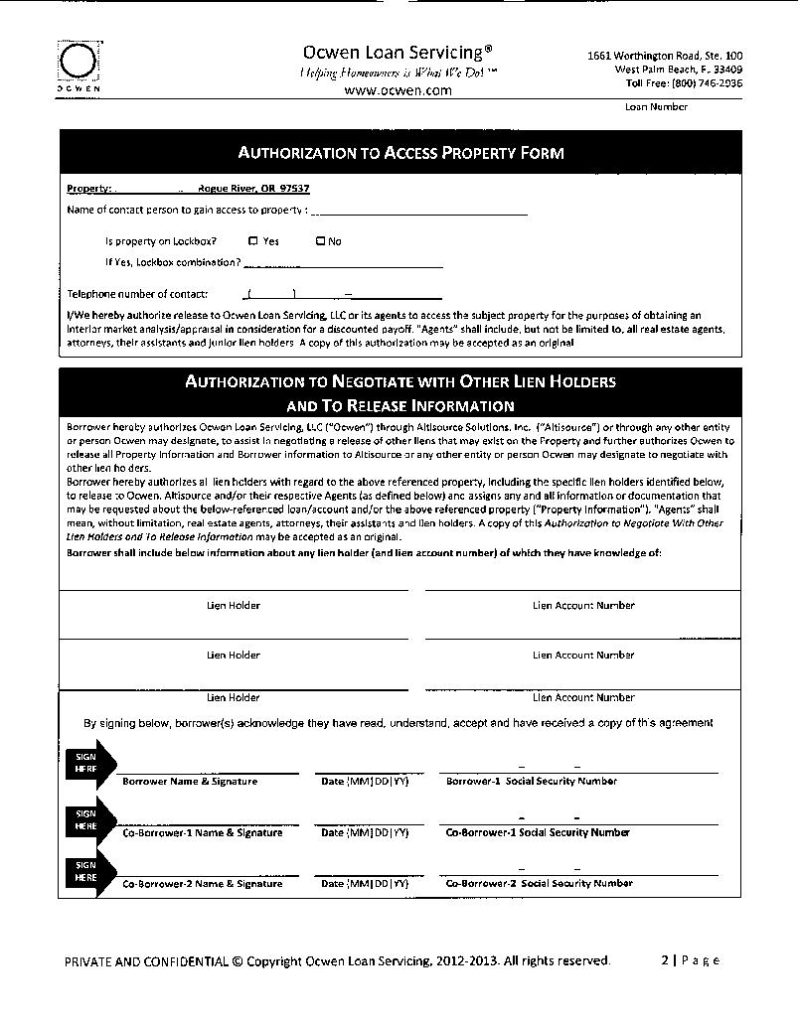

Exhibit 2

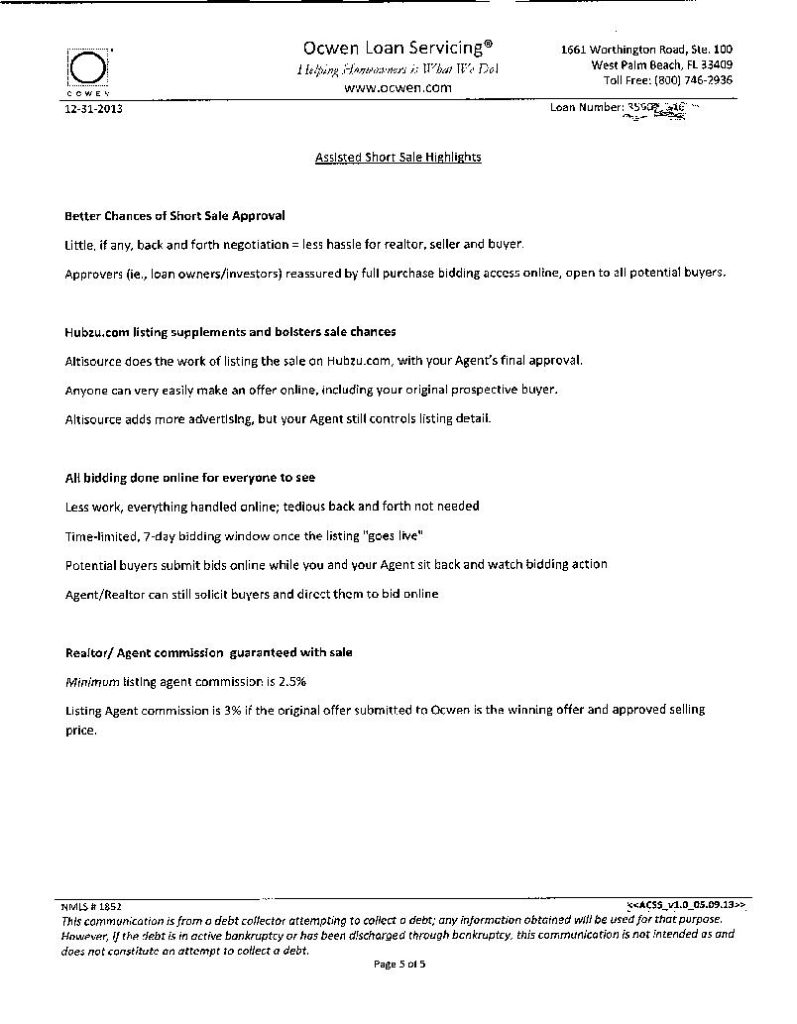

Exhibit 3